Is amazon flex 1099

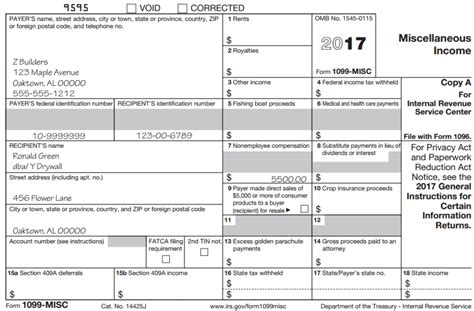

As of now, Amazon Flex drivers are classified as independent contractors only. The federal and state income taxes you owe as well as self-employment taxes (Medicare and Social Security taxes) will be your responsibility. A 1099 form is issued to self-employed delivery drivers.How to find your Amazon Flex 1099 form. Amazon Flex drivers can download a digital copy of their 1099-NEC from taxcentral.amazon.com. What to do if you don't get a 1099 from Amazon. Not all drivers are supposed to get a 1099-NEC. If you earned less than $600 in Amazon Flex income — say, if you started driving late in the year — the company ...

Did you know?

Amazon Flex offers both a W2 and a 1099 form to its drivers. Drivers who choose to work for Amazon Flex are classified as independent contractors and will receive a 1099 form at the end of the year for income taxes. However, drivers who are employed by Amazon Flex through a third-party company, such as Caviar or Doordash, will receive a W2 form ... How to find your Amazon Flex 1099 form. Amazon Flex drivers can download a digital copy of their 1099-NEC from taxcentral.amazon.com. What to do if you don't get a 1099 from Amazon. Not all drivers are supposed to get a 1099-NEC. If you earned less than $600 in Amazon Flex income — say, if you … See more4 answers. Each new offer/block has a price assigned to it, and that’s the amount you’ll receive if you accept and complete the block. A typical 3 hour block consists of delivering roughly 25-30 packages, give or take. However I’ve had as few as 4 and as many as 40. So they pretty much have a base rate for your dayshift and your evening ...

Amazon.com : NextDayLabels - 1099-NEC Forms for 2023, 4-Part Tax Forms ...I first got involved with making money outside of a traditional 9-5 job through Amazon Flex, which I have documented extensively on this website. In hindsight, it was a great way to make some extra cash, and I enjoyed the challenge of efficiently completing deliveries for customers. ... Amazon Flex 1099 forms, Schedule C, SE ©2021 MoneyPixels ...If your gross payment volume for a calendar year exceeds $20,000 and you have more than 200 transactions in that same year across all your Amazon Payments, Amazon Webstore and Selling on Amazon Accounts, you will get a copy of a Form 1099-K from Amazon Payments early in the following year.You can choose to do this once your amazon flex earnings go over £1,000 during a tax year if you like by taking advantage of the £1,000 trading income allowance. The deadline for registering is the 5th October following the end of the tax year you started working as a driver or your earnings go over the £1,000 limit.

1040, W-2, 1099 — there are quite a few tax forms that most of us have heard of (or have had to file!) at least once in our lives. But for every familiar form you regularly submit, there are dozens more that you might not have encountered j...Understanding the Amazon 1099-k. The revenue figures you see on your Amazon 1099 report is the total of the following: To track down these numbers, you simply need to download your account's date range transactions report. 1. Click Payments on your Reports tab. 2. Select Date Range Reports on your Payments page. 3. ….

Reader Q&A - also see RECOMMENDED ARTICLES & FAQs. Is amazon flex 1099. Possible cause: Not clear is amazon flex 1099.

In today’s gig economy, more and more people are looking for flexible ways to earn extra income. Whether you’re a student, a stay-at-home parent, or someone with a full-time job looking to make some additional cash, flex delivery jobs offer...To access a digital copy of your form, please follow these steps: Log in to Amazon Associates ; Hover over your email address displayed in the top right corner, and select Account Settings.

TOPS 1099 NEC 3 Up Forms 2022, 5 Part 1099 Forms, Laser/Inkjet Tax Form Sets for 50 Recipients, Includes 3 1096 Forms, 50 Pack (TX22993NEC-22) 230. $2310. FREE delivery Sat, Oct 14 on $35 of items shipped by Amazon. Or fastest delivery Thu, Oct 12. Only 15 left in stock (more on the way). In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling nearly $60 million. Now, the FTC is resending checks to people who did not cash their first check. If you get a check, please cash it within 90 days. If your payment is $600 or more, you will receive a 1099 tax form with your check.

khialat deviantart This is the "non-employee compensation" 1099 shape you receive by Amazon Flex if you earn for least $600 with them (if it is under $600, you will not receive …TOPS 1099 NEC 3 Up Forms 2022, Tax Forms Kit for 30 Recipients, 5 Part NEC Tax Form Sets with Self Seal 1099 Envelopes and 3 1096 (TX22905NEC-22) 177. Limited time deal. $1460. List: $22.49. FREE delivery Wed, Jul 12 on $25 of items shipped by Amazon. Only 8 left in stock (more on the way). properpeach leakstrex ark saddle In March, California's Labor Commissioner fined Amazon and Green Messengers Inc., a southern California DSP, $6.4 million for wage theft. The companies have appealed. Company spokesperson Rena ... patio view crossword clue Amazon Flex does not take out taxes for you. Amazon Flex drivers are considered self-employed and are responsible for their own taxes at the end of the tax year. Amazon will provide a 1099 for their Flex Drivers and …Aquí nos gustaría mostrarte una descripción, pero el sitio web que estás mirando no lo permite. petsmart tank heateroklahoma fiancee crosswordcamila.elle This is generally good practice for arriving at any appointment – but extra important because Amazon Flex only provides a 5 minute grace period. It is a good idea to aim to arrive at least 15 minutes before the start of the delivery block, as you will be able to check in at this time as well. Amazon primarily operates based on what the app ...492000. Driving for Amazon flex can be a good way to earn supplemental income. And knowing your tax write-offs can be a good way to keep that income in your pocket! Beyond just mileage or car expenses, getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write-offs: the phone you use to call residents with a locked ... taco exxpress 2 fairfield photos Sign in to Amazon.com using the email address and password that is currently associated with your Amazon Flex account. 2. Click or tap Your Account > Login & security. jimmy jphns near metulsa.craigslist.orgloud house lemon We'll issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar …As of April 2014, Flex shampoo is still produced by Revlon, although many varieties of Flex have been discontinued. Few stores carry the brand; however, it is available online at Amazon.com.